MyBoss Financial Solutions

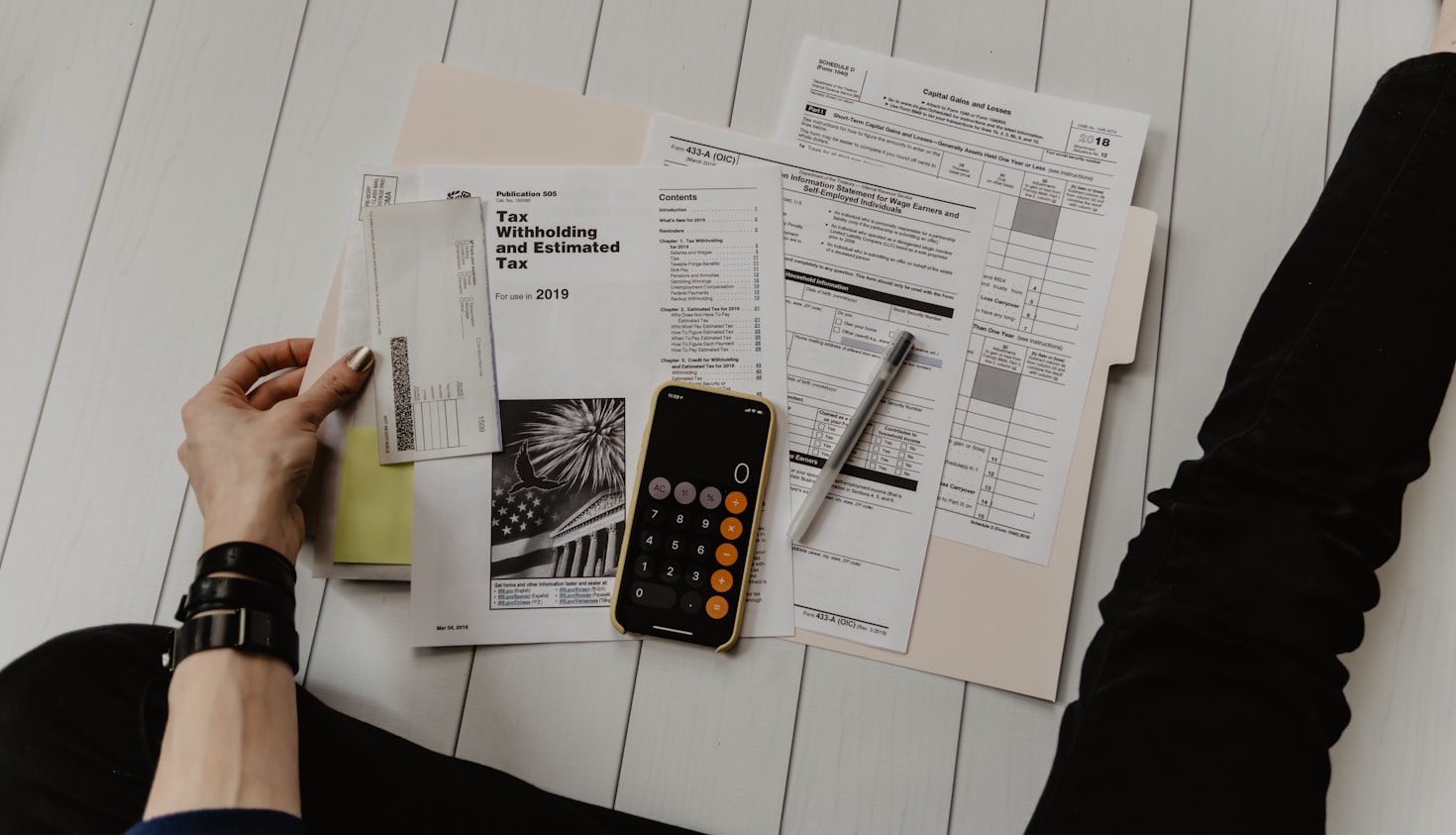

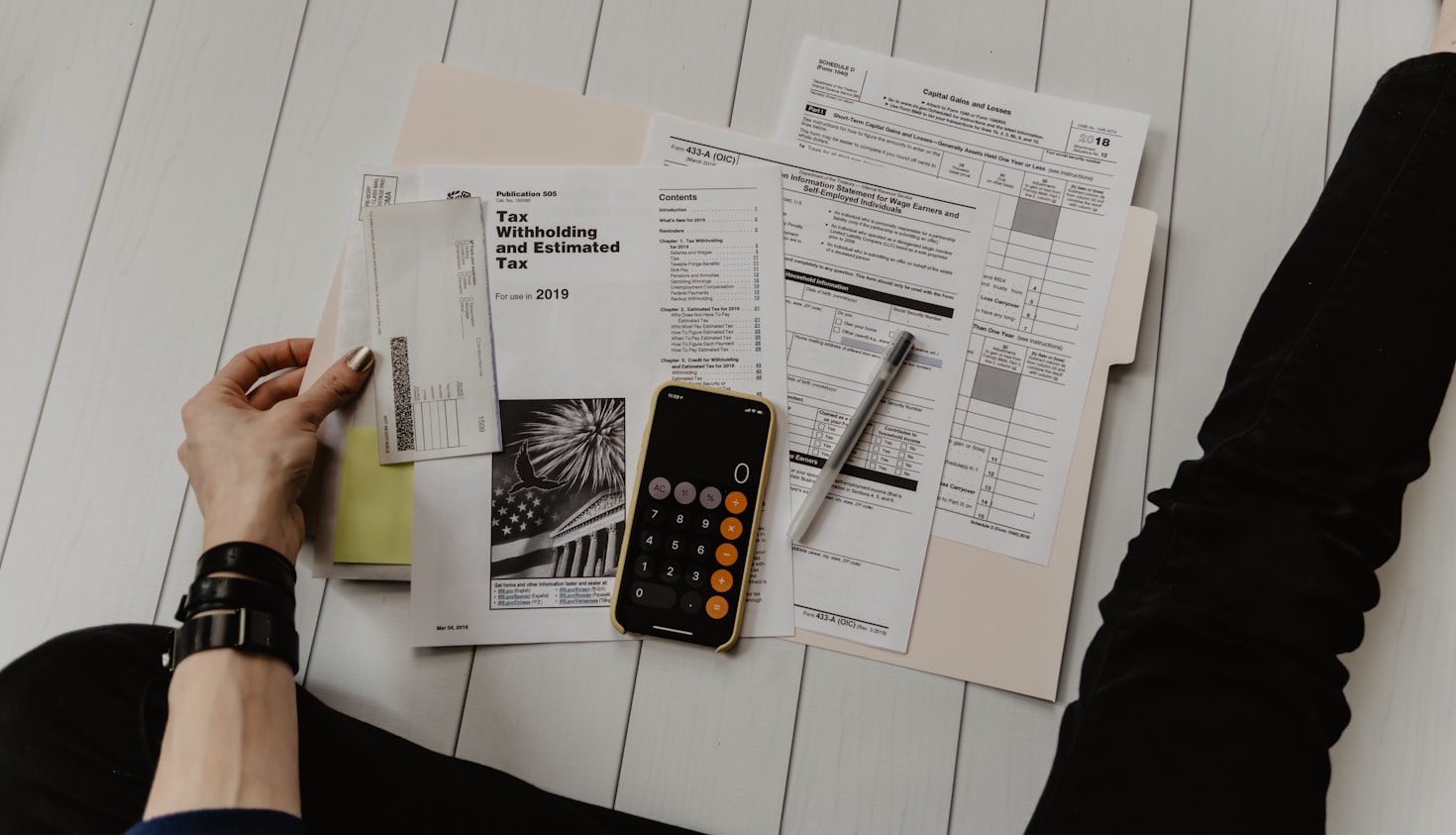

A Buffalo-headquartered consultancy offering Metro-2–based credit-repair programs, business-credit building, and done-for-you funding packages aimed at helping entrepreneurs access capital and boost personal scores.

A Buffalo-headquartered consultancy offering Metro-2–based credit-repair programs, business-credit building, and done-for-you funding packages aimed at helping entrepreneurs access capital and boost personal scores.

MyBoss Financial Solutions needed a comprehensive platform to manage their credit-repair consultancy services. They required a system that could handle Metro-2 based credit repair programs, business credit building, and done-for-you funding packages for entrepreneurs seeking to access capital and improve personal credit scores.

We developed a sophisticated credit management platform with client onboarding, credit monitoring, dispute management, and automated reporting capabilities for their Buffalo-based consultancy.

Credit Repair & Financial Consulting

8 months

8 developers

Implemented sophisticated AI algorithms for investment recommendations, risk assessment, and market prediction using TensorFlow and scikit-learn.

Built with enterprise-grade security measures and financial industry compliance standards including SOC 2, PCI DSS, and data encryption protocols.

"Kodeall built us a fintech platform that rivals the biggest players in the industry. The AI-powered recommendations are incredibly accurate, and our clients love the intuitive interface. We've seen tremendous growth since launch, and the platform handles our scale effortlessly."

Let's create a comprehensive credit repair and financial consulting platform.